Random Portfolios: Practice and Theory

Main points:

- the history of random portfolios extends at least to Chicago 1965

- testing a fund versus a benchmark takes many years to get reasonable statistical power

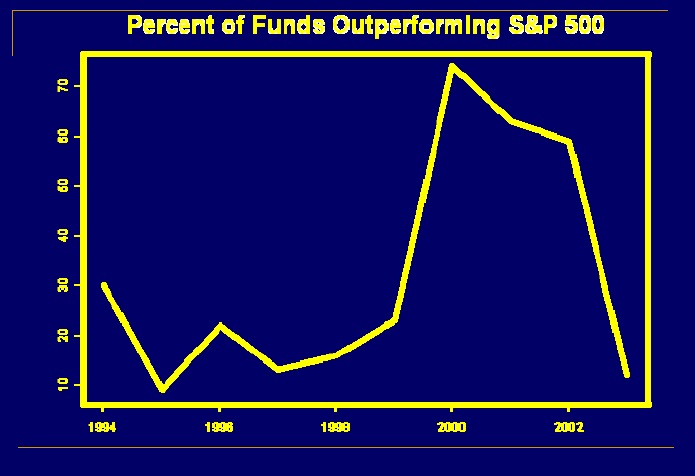

- a benchmark will be easier to beat some years versus others

- peer groups depend on the fantasy that there is little noise in the rankings of the peers

- there are open probability questions about random portfolios

- random portfolios are sometimes used like the statistical bootstrap, sometimes like a random permutation test

Presented 2009 April at the R/Finance Conference