Using Random Portfolios with R

Main points

- We could do perfect (in a sense) performance measurement if we compared what was done to all of the possible alternatives

- There are too many of those, but a random sample will do nicely

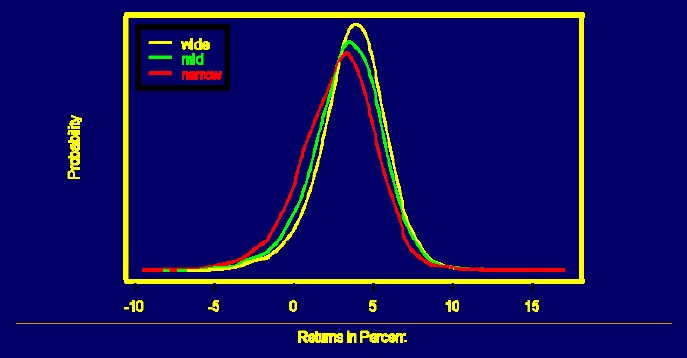

- portfolio constraints are imposed as a form of insurance

- random portfolios can help to show the cost and benefit of that insurance

- R is a good environment for such work

Presented 2009 June at the Thalesians.

There is a video of the talk on the Thalesian website (near the bottom).