Dart to the Heart

by Patrick Burns.

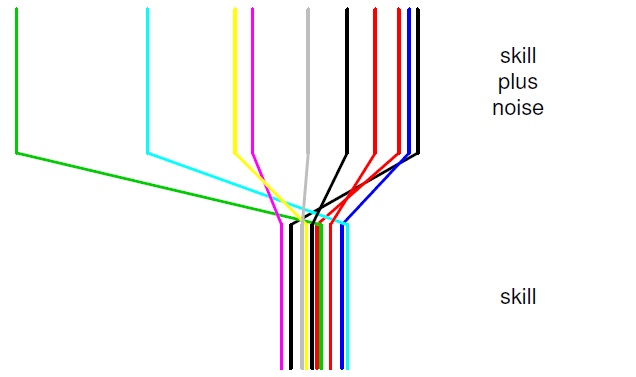

Abstract: Most likely you know of the stock market dartboard game: some reputed experts are pitted against a portfolio that was selected “by throwing darts”. This makes compelling journalism — especially when the darts win — but is less than perfect science. However, a more rigorous version of this game is good science. The enhanced method generally goes by the name of “random portfolios” or “Monte Carlo simulation”. It has the power to radically transform the practice of fund management — a dart to the heart. We will start by taking a close look at performance measurement. We will then move on to some wider issues of fund management.

This version: 2007 March 08 (pdf)

A slightly edited version of this appeared in the March 2007 issue of Professional Investor under the title “Bullseye”.