Does My Beta Look Big in This?

by Patrick Burns.

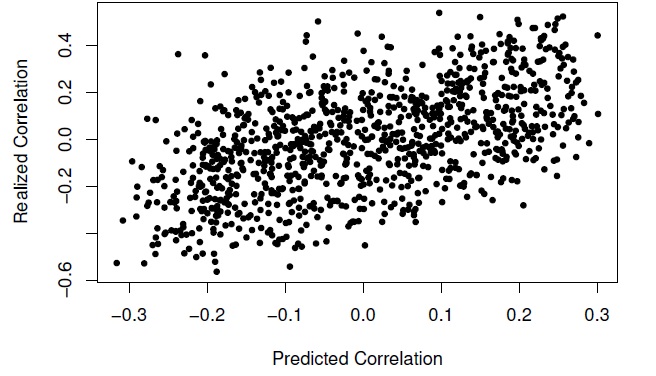

Abstract: Simulations are performed which show the difficulty of actually achieving realized market neutrality. Results suggest that restrictions on the net value of the fund are particularly ineffective. A negative correlation — that is, market negativity — is proposed as a more reasonable target, both on theoretical and practical grounds. Random portfolios — portfolios that obey given constraints but are otherwise unrestricted — prove themselves to be a very effective tool to study issues such as this.