The Quality of Value at Risk via Univariate GARCH

by Patrick Burns.

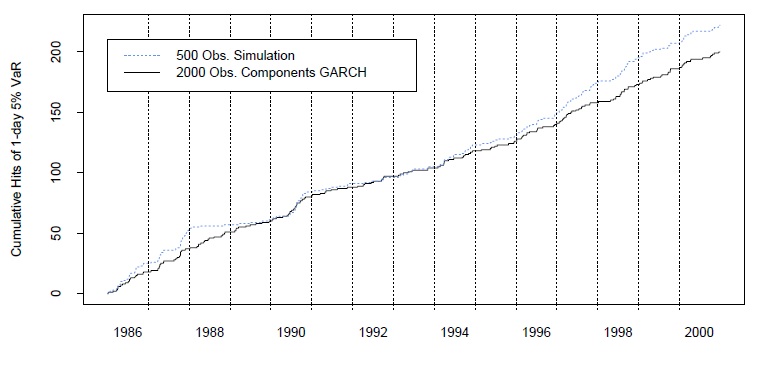

Abstract: The estimation of value at risk using univariate GARCH models is examined. A long history of the S&P 500 is used to compare these estimators with several other common approaches to value at risk estimation. The test results indicate that GARCH estimates are superior to the other methods in terms of the accuracy and consistency of the probability level. Although all of the GARCH models tested performed relatively well, the quality of the value at risk estimate does depend on which particular GARCH model is used. Weighting recent observations more heavily when fitting the GARCH model seems to be beneficial.